How to identify a crypto game SCAM quickly

Cryptocurrency scams are becoming more and more common, learn how to avoid falling for crypto gaming scam projects, and find out how some of them operate.

Do you know what a scam project is? At Techshali.com we care about your financial well-being, so we decided to create this guide in which you will learn more about this term, how to avoid falling into a scam and the details of the most talked-about scam in 2024.

And with the growing popularity of cryptocurrencies also comes scams that could make you lose all your invested money. In fact, more than $19 million in scams have been recorded since 2017, and 2021 was on course to become the year with the most reported crimes of this type. The FTC reported that over 46,000 people lost over $1 billion to crypto scams from January 2021 through March 2022 alone.

Cryptocurrency users lost nearly $2 billion in 2023 to various scams, hacks, and rug pulls. (Source: CoinDesk). This figure represents a decrease compared to the $4.2 billion lost in 2022. Reports indicate that even though the number of scams might be decreasing, the amount lost per scam can be significantly higher. The sophistication of crypto scams is constantly increasing, making it likely that substantial losses will continue to occur.

The most frequent victims are those with little knowledge of cryptocurrency management, with scammers preying on novices who are looking for oasis opportunities: those that promise to deliver big results in a short time but end up being unrealistic.

What is a Crypto Game Scam?

To clarify what is a scam in cryptocurrencies, as a kind of robbery, cybercriminals manage to create irresistible proposals and thus incite victims to fall into the deception. This is what is called a scam project, which has no legal status.

This type of scam has increased since cryptocurrencies became popular, and is based on tokens, originated by criminals, in which victims invest their money without being able to withdraw it later.

On the other hand, there are also fake email marketing campaigns, websites created for scams, even the use of fake identities with which they can promote these scam projects.

Signs that a gaming crpyto project is a scam

The secret to avoiding falling for online scams is to stop being a novice and start understanding more about the basic characteristics of fake cryptocurrencies. For this, we leave you a list with which you will learn how to quickly identify scam projects:

1. Closed-source Cryptos

One of the first things to check before trusting any token is its code. Is it a closed source? Or, does it not disclose its source code? Then you start to doubt its veracity.

A cryptocurrency that is worthy of respect presents its open-source code, which can be viewed by any user. It also allows it to be modified or redistributed. This helps the community to contribute to the improvement of the token.

However, when it comes to fake cryptocurrencies, most of them do not release their code, because in many cases it does not exist, i.e. they do not have a codebase.

In the best-case scenario, the crypto should display a link to its source code. Or, if it does not have one, publish a transaction browser with which users can make sure that the tokens are trustworthy.

2. Fake important data

Every cryptocurrency must have authentic and verifiable data which serves to increase the trustworthiness of the tokens. However, in most cases, fake cryptocurrencies hide information such as their white paper, or the true identity of their promoters.

As for white papers, they are a kind of roadmap that guides everything related to the technical aspect of the coins; each token should have its own white paper. The absence of this information is a very clear sign that the offer might be a scam, as there would be no way of knowing exactly the purpose and dynamics of the crypto.

If, on the other hand, you come across a plagiarized white paper, it should also be a matter of doubt, as this information is unrepeatable for each token.

On the other hand, take a closer look at the users who preach the use of cryptocurrency, you may have another point to doubt when you want to verify their profiles. In many cases, scam project promoters base their profiles on fake identities, or simply do not have links where you can find out more about their recent professional activities, but you will see the “riches” they have obtained with their token.

3. Earnings that exceed all expectations

Here we focus on what scam ambassadors offer you. They will often present the project to you as a unique investment opportunity where your profit rate could double up to 200%.

Beware! When they offer percentages above 80%, you should start to doubt the proposal. Well, Eloisa Cadenas; crypto expert, quoted by Forbes, explains that the highest returns can be up to 25%, and are already considered risky.

Likewise, these proposals are usually accompanied by urgent appeals: “Receive the last discount of the year with which you will generate a lot of profit, invest now! Do not get carried away by these calls and first verify the veracity of the tokens.

4. Pyramid schemes as a basis

A common strategy of scam projects is to use ponzi schemes to look like “cash” among early adopters. However, as is characteristic of this type of scam, only a few are the ones who actually win.

In the cryptocurrency world you will usually be offered: cloud mining, crypto investment packages and multi-level marketing schemes, all of which represent a scam in which you will hand over your money to third parties who will never vouch for it.

This type of scam usually works until new users stop coming, so to sign up you will usually have to work with referrals, or pay a membership fee and then wait for others to pay their share before you can get your earnings.

Nowadays it is very easy to plagiarise websites, social profiles, send emails and create apps just to fool the unwary.

Well, many fraudsters have specialised in plagiarising websites, which look very similar to the original ones, so many users access them without knowing their true origin. Therefore, when accessing what appears to be your trusted website, check that the connection to the site is secure, and preferably that it starts with “HTTPS”.

Similarly, hacking into social networks, or plagiarising identities on these platforms, has become popular among cybercriminals.

In addition to this, many fraudsters have harnessed their talents to produce fraudulent mobile apps, which are usually available on the App Store or Play Store, and offer token exchanges with very good returns.

You should be very careful about which links you click on in your email, as many may pose as trustworthy companies without any legal backing.

6. Opaque Tokenomics

The term “opaque tokenomics” raises a red flag in the world of cryptocurrency projects. Unlike transparent projects that clearly outline their token’s purpose, distribution, and mechanisms for generating value, projects with opaque tokenomics shroud these details in mystery. This lack of clarity often masks unsustainable economic models, hidden risks, or even the potential for outright scams. Investors may find themselves attracted by lofty promises, only to discover a token that lacks clear utility or whose value is artificially manipulated.

When a project’s tokenomics are unclear, it’s impossible to make informed investment decisions. A lack of transparency makes it difficult to judge if the token holds any real potential for growth or if it’s a highly speculative gamble. A healthy dose of skepticism is crucial when approaching projects with vague or poorly explained tokenomics. It’s always best to prioritize projects that are upfront about their economic models, ensuring you understand the value proposition of the token before taking the plunge.

7. Heavy Focus on Marketing, Little on Development

Sometimes projects promise the moon, with huge marketing campaigns touting revolutionary ideas and groundbreaking features. They splash flashy ads everywhere, promising to change the way we play. But be careful; all that glitters isn’t gold. If you dig a little deeper, you might find there’s not much substance behind the hype. The promised game is nowhere in sight, and the whitepaper seems more focused on buzzwords than actual technology.

Projects like this can be tempting; everyone wants to be part of the next big thing. But it’s important to remember that building a truly innovative game takes time, effort, and a dedicated team. If a project seems to be prioritizing hype over showcasing their progress, it’s a good idea to be cautious. Look for a balance between vision and real, tangible development – and be wary of those who promise you the world without showing you how they’ll build it.

The most controversial NFT game scam projects

This year there have been several reported incidents of cybercriminals taking advantage of users with little or no information regarding the handling and operation of tokens.

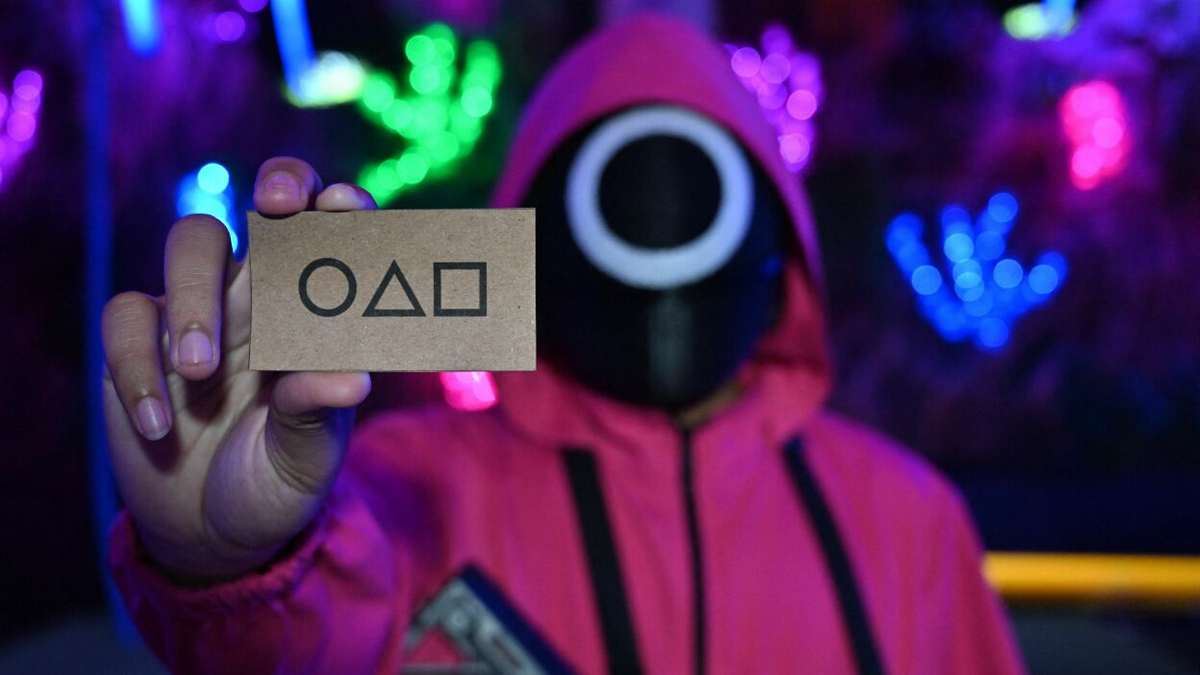

One of them was the scam that YouTuber Simon Zawa almost fell for while investigating the Squid Game Token cryptocurrency, which based its popularity on the famous Squid Game and, moreover, posed as an official Netflix production.

So Zawa decided to do a live stream while documenting the Squid Game, but what he didn’t expect was that he would record the moment when the coin went from being worth $2,800 to $0 in a couple of seconds. Thus, this Scam project allowed the purchase of the token, but not the sale of it, so users who decided to invest lost their money in this already known scam.

Frosties, Promoted by popular influencers, the Frosties NFT collection promised ongoing development and rewards. The team disappeared shortly after the sell-out, leaving the community with broken promises and a worthless investment.

Evolved Apes, This project promised a fighting game where players could use their Evolved Ape NFTs. After raising millions, the developers vanished, leaving holders with worthless JPEGs and a blatant rug pull.

Key Factors Contributing to Controversy:

- Exploiting Hype: Many of these projects capitalized on popular trends or established brands to generate excitement and FOMO.

- Deceptive Marketing: Aggressive marketing campaigns with unrealistic promises and false partnerships lured in unsuspecting investors.

- Lack of Transparency: Anonymous teams, poorly defined roadmaps, and a lack of communication fueled distrust within the community.

Conclusion

When betting on a token, make sure you have all the information you need to check the transparency of the cryptocurrency you are about to acquire. Remember that even though it may seem like a real project, we must often look between the lines to see the small details that make the difference.

I hope this post has helped you to clarify your doubts about what is a scam project? I will be reading in the comments your experience regarding these unpleasant moments.