How to Find the Best Credit Card for You in Three Easy Steps

Due to the income shocks and rising unemployment that happened as a result of the pandemic, families may have been less likely to pay off their debt, while some financial institutions have started limiting consumers’ access to credit.

It may take some time to find the ideal credit card for you as each person is unique and has different financial needs.

When you understand your options and follow these tips, you will be able to select the card that is the best fit for your needs and habits.

3 Steps to Find the Perfect Credit Card for You

We all dream about finding a credit card for bad credit no deposit as it sounds like a perfect option.

In reality, no credit card issuer can guarantee that your request for an unsecured card will be approved without a security guarantee.

1. Check Your Credit Score

Some providers have minimum requirements while having a good credit score is essential. If you check your current credit rating, you will be able to learn about the potential credit card offers you can qualify for.

The higher your rating is, the greater the chance of getting approved for the best credit card offers.

Prime credit holders are usually offered the best perks and lowest interest rates. How can you check your current rating?

You may order your free annual credit report from one of the three credit reporting agencies such as TransUnion, Equifax, or Experian.

Besides, the majority of credit card issuers offer cardholders free FICO scores. The credit report will give you a better understanding of your issues.

Moreover, you may utilize a credit score service and website to get your current score or talk to a non-profit counselor. Some platforms such as myfico.com allow consumers to buy a score.

It’s important to know what exactly the main cause of your low credit is. Once you define the problem, it will be easier to figure out ways to solve it.

You may dispute the errors in your credit report if you find them, or change your spending habits if you overspend and max out your credit cards.

2. Choose the Type of Credit Card

You may select between several types of credit cards depending on your financial situation and your needs. Which credit card will suit your needs?

A student who wants to build credit will definitely choose a different card than a frequent traveler who aims to gather miles. So, you should define your individual reasons for getting a credit card.

Typically, there are three main types of credit cards:

- Tools that help you boost your credit rating. Getting a secured or a student card is great for this purpose. Secured cards demand a security deposit of $200 or higher which will be returned to you when your account is closed in good standing or upgraded. Student credit cards are usually unsecured and are meant for establishing credit.

- Tools that earn rewards. If you repay your balance in full each month, you may obtain a rewards credit card to get travel bonuses and cash back. Such crediting tools usually have higher APRs but also come with sign-up perks, additional miles, and other bonuses.

- Tools that save money on interest. You may select a 0% APR or balance transfer card or a low-interest crediting tool. It will be a good match for consumers if they only want to utilize their cards for emergencies rather than on a regular basis.

3. Apply for the Card of Your Choice

Once you decide what your present financial situation is and the reasons for getting a card, you can finally apply for it. Visit the page of the credit card and select the “Apply Now” option.

You will be asked to fill in the necessary details in the application form. Your personal data, financial details, and email are needed to begin the process. Submit your request and wait for the answer.

Once you receive the response, you should wait up to 10 business days to obtain your card.

In case your request was rejected, you may call the credit card issuer’s reconsideration line to check for possible changes. Otherwise, pick another credit card.

Credit Card Limits Are Rising after the Pandemic

Credit card limits keep on increasing for most groups after stagnating during the global pandemic, according to the information from Consumer Financial Protection Bureau.

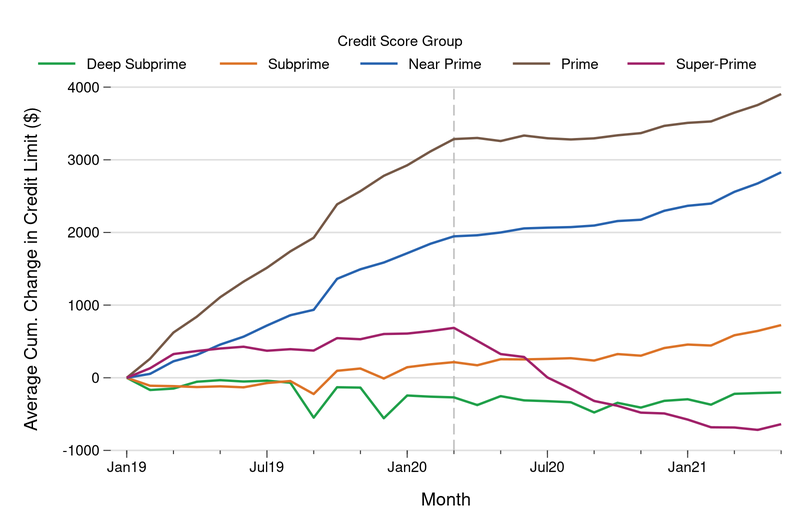

The following chart shows that total limits on credit cards have lowered during the global pandemic for borrowers with the highest credit rating, while it stagnated for others.

Beginning in February 2021 limits began to increase faster for prime and near-prime borrowers. On the contrary, credit limits were lowered for super-prime borrowers.

The typical super-prime borrower had around $640 less credit card credit in May 2021 compared to the beginning of 2019.

Limits for subprime and deep prime applicants didn’t change a lot during the pandemic.

What Should You Do Next?

Once you have found an ideal credit card for your financial purposes, your journey just begins. You should read carefully and know all the benefits and downsides of your credit option.

The perks and benefits can help you get the most out of your funds and take advantage of your choice. Make sure you pay the bill each month if you’ve taken out a student card to build credit.

Those who have opted for a 0% APR option should be responsible with their debt repayment plan and remember about on-time payments to avoid high interest.

Utilize your card for daily purchases to rack up bonuses and rewards. Make this crediting tool work for you and help you reach your monetary targets.

The Bottom Line

Each consumer is unique so there isn’t a one-size-fits-all answer on which credit card will work best for you.

Use our tips and three steps to help you select the most appropriate tool to suit your financial needs and achieve your aims.

Remember that your credit score plays an important role in getting approved for the best card with the lowest interest so ensure you check your credit report and have a good or excellent rating.

Whether it’s earning rewards, borrowing some cash, or building your credit, make sure you pick the most efficient and affordable card to suit your needs.