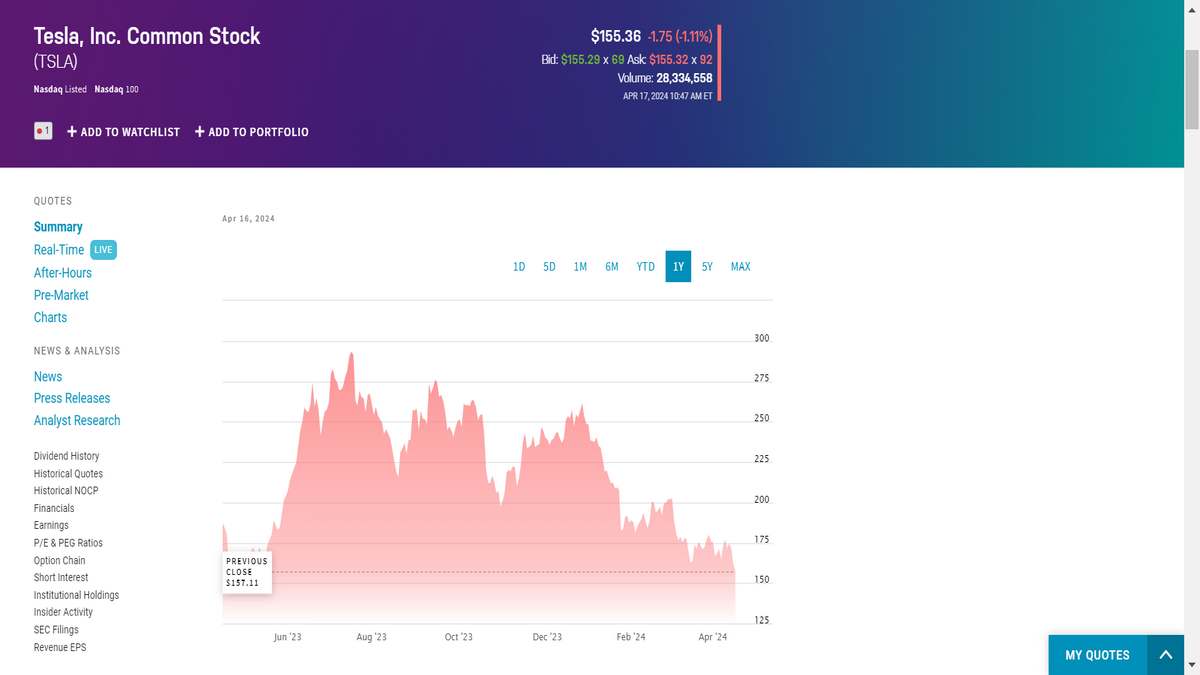

Tesla Shares Plunge 37% in 2024 as Demand Concerns Loom, Market Value Dips Below $500 Billion

Tesla Inc. (NASDAQ: TSLA), the world’s leading electric vehicle (EV) manufacturer, grapples with a significant share price decline in 2024. Year-to-date, the automaker’s stock has lost 37% of its value.

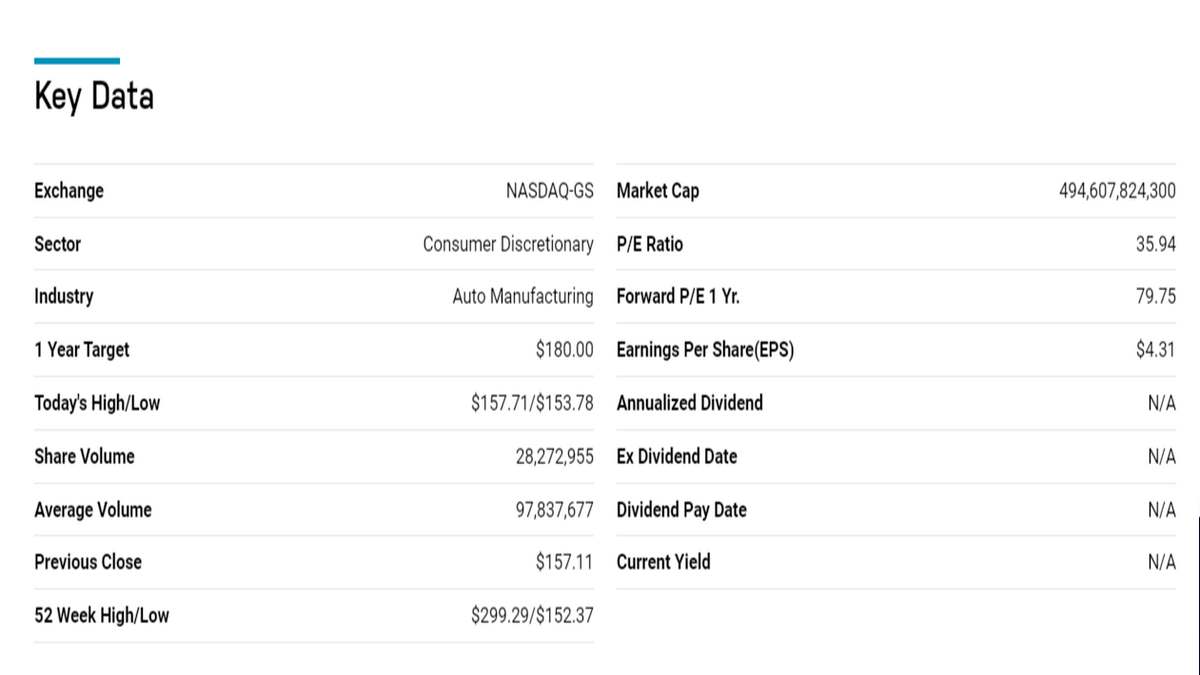

This downturn has also pushed the company’s market capitalization below the $500 billion mark, raising concerns about a slowdown in demand and increased competition within the EV industry.

Key Figures

- Tesla’s share price as of April 17, 2024, stands at approximately $154. This contrasts sharply with its closing price at the end of 2023.

- The 37% drop represents one of the most significant declines for Tesla in recent years and has erased significant shareholder wealth.

- Notably, Tesla shares were the second-biggest drag on the performance of the S&P 500 Index in 2024 thus far.

Why Tesla Shares Declines 37% in 2024: Factors Behind the Decline

Market analysts point to several potential triggers contributing to Tesla’s stock decline:

Demand Concerns Take Center Stage

The primary concern driving Tesla’s stock decline appears to be a potential slowdown in demand for its vehicles. This slowdown could manifest due to several factors:

- Market Saturation: Early movers in the EV market like Tesla might be experiencing saturation within certain segments, particularly high-end luxury electric vehicles. As more consumers become familiar with EVs, they might opt for budget-friendly options offered by established automakers or new entrants.

- Economic Factors: A potential economic slowdown could negatively impact consumer spending, particularly on high-ticket items like electric cars. Rising interest rates and inflation might lead to stricter household budgets, pushing some potential buyers out of the market.

- Competition Heats Up: Tesla’s once-dominant position in the EV market is under increasing pressure. Traditional automakers like Ford, General Motors, and Volkswagen are investing heavily in EV development and production. These legacy players leverage existing manufacturing infrastructure and established dealer networks, potentially offering more competitive pricing and shorter delivery timelines.

- Additionally, Chinese EV makers such as BYD and Nio are rapidly expanding their global presence. These companies excel at offering feature-rich EVs at attractive rates, challenging Tesla’s hold on specific market segments.

- Model Refresh Cycle: Tesla’s product lineup might be nearing a refresh cycle, leading to potential buying delays. When new models are on the horizon, some consumers are likely to wait for the latest technology and features before committing to a purchase.

Production and Supply Chain Issues

While not the sole factor, production and supply chain disruptions could also contribute to the perceived slowdown in demand.

- Geopolitical Tensions: The ongoing conflict in Eastern Europe and strained trade relations between the US and China can disrupt supply chains for critical components needed in EV production. These disruptions can lead to production delays and limited inventory availability, further dampening consumer confidence.

- Battery Shortages: The rapidly growing EV industry faces significant pressure on battery production. Tesla, like other automakers, might face difficulties securing enough batteries to meet its production targets. This could lead to production slowdowns and missed delivery deadlines.

Internal Restructuring and Leadership Considerations

Tesla’s recent announcement of job cuts across various departments has sparked speculation about internal adjustments.

- Demand Adjustments: The job cuts could be a strategic decision in response to the potential slowdown in demand. By streamlining operations, Tesla might be aiming to optimize production costs and maintain profitability in a more competitive landscape.

- Investor Confidence and Leadership: The timing of these job cuts coincides with the stock price decline, raising concerns among some investors. Some analysts suggest that Elon Musk’s divided focus on multiple ventures, including his recent acquisition of Twitter, might be creating uncertainty about Tesla’s future leadership.

It’s important to note that these factors may be intertwined. For instance, production disruptions caused by geopolitical tensions could limit supply, hindering Tesla’s ability to meet existing demand and forcing potential buyers to wait.

The decline in Tesla’s share price likely stems from a confluence of factors. While demand slowdown appears to be the central concern, competition, economic uncertainty, production issues, and leadership considerations all play a role in the complex picture.

The Competition Landscape

The EV market has become increasingly competitive in recent years, presenting challenges to Tesla’s early dominance: Here’s a deeper dive into the competitive landscape that Tesla navigates:

Legacy Automakers Rise to the Challenge:

- Traditional car manufacturers like Ford, General Motors, and Volkswagen possess vast production capabilities, extensive dealership networks, and brand recognition. They are leveraging these assets to rapidly develop and launch competitive electric vehicles.

- These established automakers are investing heavily in EV technology and production facilities. Ford, for instance, has committed to investing $50 billion in electric vehicles by 2026.

- This focus on EVs allows legacy automakers to offer a wider range of electric vehicles catering to various consumer needs and price points. They can potentially undercut Tesla on price by leveraging existing manufacturing infrastructure and established supply chains.

Chinese EV Makers Make Waves:

- Chinese electric vehicle companies like BYD (Build Your Dreams) and Nio have emerged as significant players in the global market.

- BYD, in particular, has established itself as a leader in battery technology and electric vehicle production. In the first quarter of 2024, BYD outsold Tesla in terms of electric vehicles delivered.

- These Chinese manufacturers offer technologically advanced EVs at competitive prices, often benefiting from government subsidies and lower production costs.

- Additionally, Chinese EV companies are rapidly expanding their global presence, posing a direct threat to Tesla’s market share in key regions like Europe and Asia.

Price Sensitivity and Market Saturation:

- As the EV market matures, price is becoming an increasingly important factor for consumers.

- A potential economic slowdown could place a premium on affordability, putting pressure on Tesla, whose vehicles have traditionally been positioned at the premium end of the EV market.

- There are also concerns about market saturation in certain EV segments, particularly luxury SUVs and sedans, where Tesla has enjoyed strong sales.

- As more competitors enter the market with compelling options, Tesla may need to diversify its product portfolio or adjust its pricing strategy to cater to a broader range of consumer budgets.

Beyond Traditional Automakers:

- The competitive landscape also includes start-up companies developing innovative electric vehicle technologies and business models.

- These new entrants may not pose an immediate threat to Tesla’s market dominance, but they have the potential to disrupt the industry with fresh ideas and approaches.

Industry Outlook

While the decline in Tesla’s share price raises questions about near-term performance, the overall trajectory of the EV market remains positive.

Government policies promoting EV adoption, rising fuel prices, and growing environmental awareness are expected to fuel the long-term growth of the electric vehicle sector.

The Road Ahead

Analysts emphasize that Tesla continues to possess significant advantages including strong brand recognition, advanced technology, and a dedicated customer base.

However, the company’s recent share price performance signals rising pressure on Tesla to address potential demand challenges, navigate an increasingly competitive market, and maintain investor confidence.