Calendar Spread Options: Mastering Time-Based Option Strategies

Hey there, options enthusiasts! Today, we’re diving into the exciting world of calendar spread options. If you’re looking to take your options trading game to the next level, understanding these time-based strategies is a must. In this comprehensive guide, we’ll walk you through the ins and outs of calendar spreads, the mechanics behind them, their benefits, and everything you need to know to make informed trading decisions. So, let’s get started!

Understanding Options Trading Basics

Before we jump into calendar spreads, let’s quickly review the basics. Options contracts, my friends, are financial instruments derived from underlying assets. We have call options, which give you the right to buy an asset at a specific price, and put options, which grant you the right to sell an asset at a predetermined price. It’s like having a trading superpower!

Exploring Time Decay and Its Significance in Options Trading

Now, let’s talk about time decay. Picture this: options have an expiration date, and as time goes by, their value tends to erode. That’s time decay, also known as theta. It’s essential to grasp this concept because it’s at the core of time-based option strategies like calendar spreads. Understanding how time decay affects options premiums is the key to unlocking potential profits.

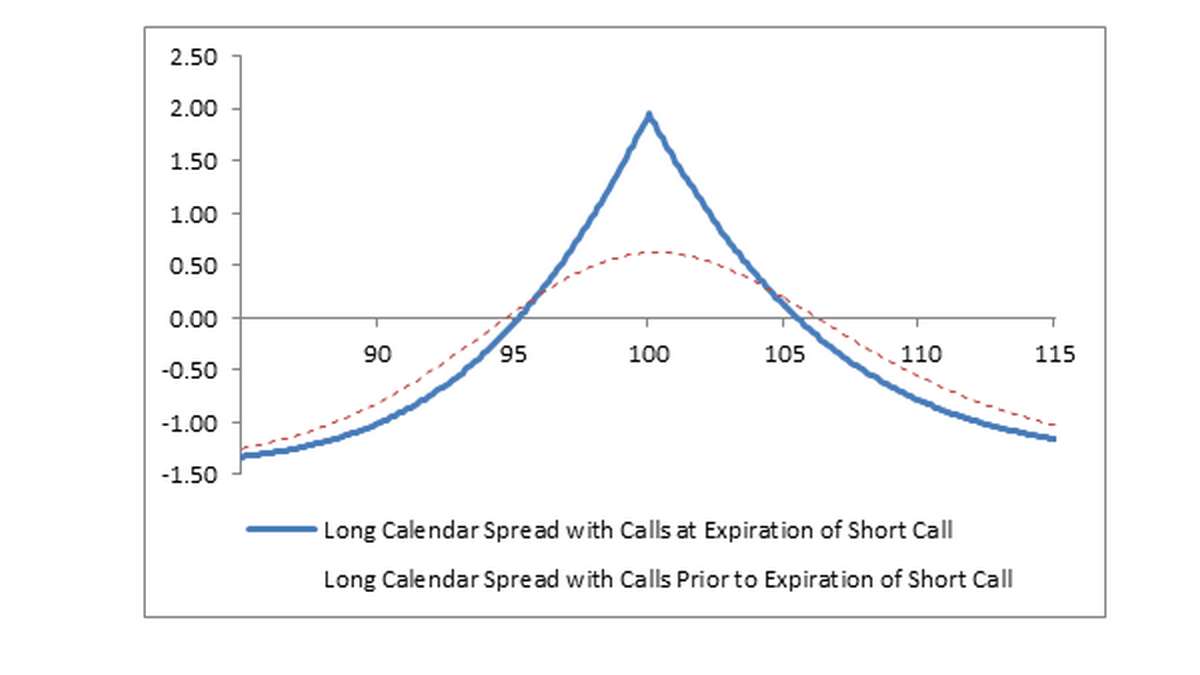

The Mechanics of Calendar Spread Options

Alright, let’s dive into the nitty-gritty of calendar spreads. A calendar spread, folks, involves simultaneously buying and selling options with different expiration dates. You’re creating a spread between them. Why? Well, by taking advantage of time decay, you can generate income while managing risk. You select different expiration dates and strike prices to construct your spread, giving you flexibility in your trading approach.

Benefits and Considerations of Calendar Spread Options

Now, let’s talk about why calendar spreads are so enticing. First off, you can generate income through time decay. As time passes, the value of the option you sold will decrease, and you keep the premium. Second, calendar spreads come with defined risk profiles. You know your maximum potential loss from the start. Lastly, flexibility is the name of the game. You can adjust your positions and expiration dates, giving you room to adapt to changing market conditions.

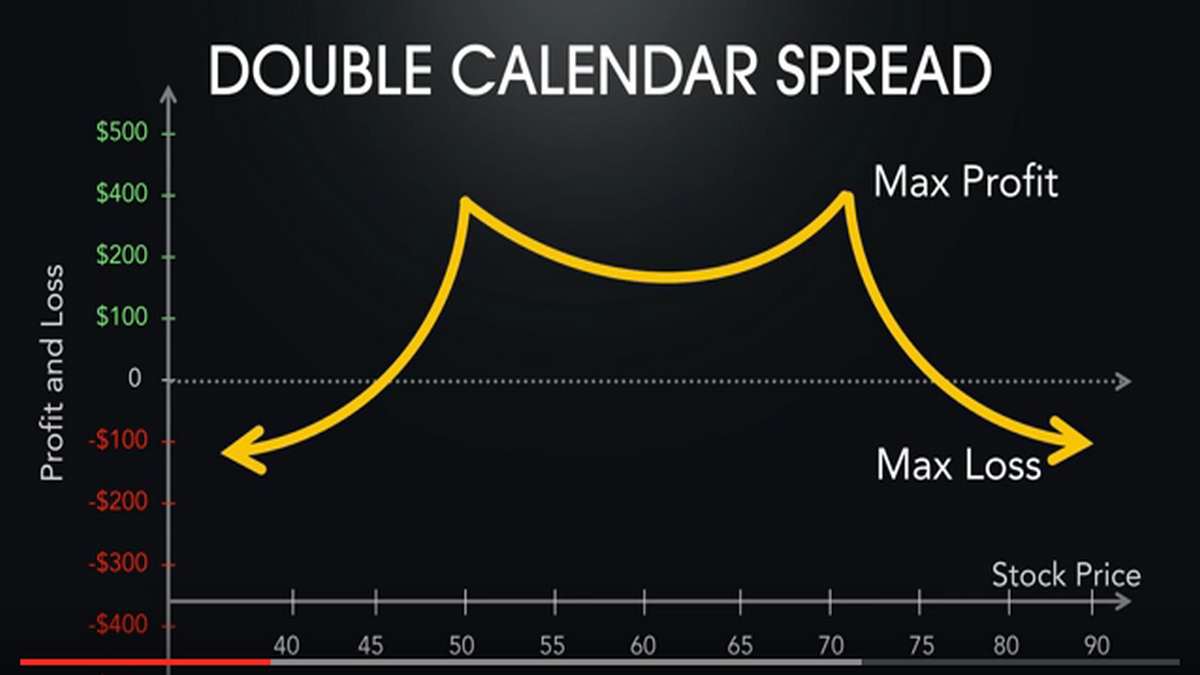

Variations of Calendar Spread Options

Calendar spreads have some fantastic variations to suit different market outlooks. If you’re feeling bullish, you can go for a bullish calendar spread. Conversely, if you’re sensing bearishness, a bearish calendar spread might be your go-to choice. And hey, if you believe the market will remain neutral, a neutral calendar spread is right up your alley. There’s something for everyone!

Factors to Consider when Trading Calendar Spread Options

Before you jump headfirst into calendar spread trading, let’s cover some important factors to consider. Volatility analysis and implied volatility play a significant role in these strategies. Market conditions and trends also come into play, as does your time horizon and event risk. Oh, and don’t forget about proper position sizing and risk management. It’s all about making informed decisions.

Monitoring and Adjusting Calendar Spread Positions

Once you’ve established your calendar spread positions, the fun doesn’t stop there. Regularly monitoring and analyzing your positions is crucial. Assessing their performance helps you make informed decisions. If necessary, you can adjust expiration dates and strike prices, roll positions forward, and handle early assignment or exercising options. Stay on top of your game!

Case Studies: Real-Life Examples of Calendar Spread Trades

Let’s spice things up with some real-life examples, shall we? We’ve prepared three case studies to demonstrate how calendar spreads can be applied in different market scenarios. Whether it’s a bullish, bearish, or neutral market, there’s a calendar spread strategy to suit your trading style and market outlook. These case studies will give you a practical understanding of how calendar spreads can be profitably implemented.

Tips and Best Practices for Successful Calendar Spread Trading

Now, let’s dive into some tips and best practices to help you excel in calendar spread trading. Understanding the relationship between time decay and profitability is key. Practice proper position sizing and risk management to protect your hard-earned capital. Consistently monitor and analyze your positions, and be ready to adapt as market conditions change. Remember, patience and discipline are your allies.

Frequently Asked Questions (FAQs)

Here are answers to some common questions about calendar spread options:

Q: What’s the difference between a calendar spread and a diagonal spread?

A: In a calendar spread, both options have the same strike price, but different expiration dates. In a diagonal spread, both the strike price and expiration dates are different.

Q: How does implied volatility impact calendar spread options?

A: Higher implied volatility generally leads to higher option premiums, which can work in your favor when selling options for income generation.

Q: Can calendar spread options be used on any underlying asset?

A: Yes, calendar spreads can be applied to a wide range of underlying assets, such as stocks, indices, commodities, and more.

Q: How do I choose the strike prices for a calendar spread?

A: Select strike prices that reflect your market outlook and risk tolerance. Generally, the sold option is slightly out-of-the-money, while the bought option can be either further out-of-the-money or at-the-money.

Q: What are some alternative strategies to calendar spread options?

A: Other popular strategies include vertical spreads, iron condors, and butterfly spreads. Each strategy has its unique characteristics and risk-reward profiles.

Conclusion

Congratulations! You’ve just embarked on a journey to master the art of calendar spread options. By understanding the mechanics, benefits, and variations of these time-based strategies, you’re well-equipped to make informed trading decisions. Remember to consider market factors, practice risk management, and stay adaptable in your approach. With patience, discipline, and continuous learning, you can unlock the full potential of calendar spreads in your options trading arsenal. So, go out there and seize those opportunities!